With all the talk lately about the housing market (both here in Hawaii and across the nation), robo-signing, the down economy, foreclosures, bank failures and bailouts and who knows what else, you may be wondering what your Hawaii house is really worth. Maybe you are facing a hardship and may need to sell your house quickly or maybe you bought some Hawaii real estate as an investment and are watching your equity shrink. That deal may be a deal no more. Or perhaps you made a wise investment in the past and are looking to cash out that equity now instead of waiting for the market to rebound at some point in the future.

Regardless of your reasons, it’s important to know how to properly calculate the value of your house. You can’t rely simply on the most recent tax appraisal. Having this knowledge will allow you to not only know what to expect if you decide to sell, but it will help you compare offers when they do come in. Before we even look at the criteria, it’s absolutely critical to remember the most important rule of selling your house (or anything, for that matter):

Your house is only worth what someone is willing to pay for it.

That might sound a bit harsh, but many people today think their house is worth more than it really is. It’s perfectly natural to feel that way — we have memories there, we raised our children there. Our houses often become part of our lives. But that goes out the window when we sell it because those memories are not of value to a new buyer. We need to remain objective and unemotional, as difficult as that can be.

That being said, let’s get right into figuring out the value of your house. The first thing you need to do is find an information source of recently sold houses. You could get these from a real estate website, such as Zillow, Cyberhomes or Trulia, or you can contact an investor or realtor who has access to the MLS listings (multiple listing service). Then search to find houses that fit the following criteria:

1. Have sold in the past 3 months. This lets you account for the current state of the housing market. A house in Honolulu that sold 12 months ago does not reflect what the market would pay for that same house today, so keep it current. Go beyond 3 months if you must, but anything more than 6 months old is probably not worth considering.

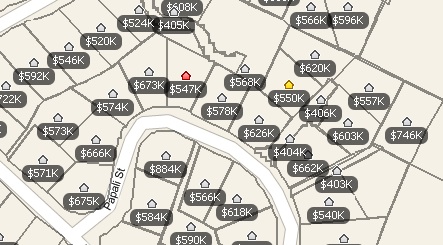

2. Is within a mile of your house. A half mile is even better. You want to make sure that you don’t compare houses in vastly different neighborhoods. Kapolei and Makakilo may be close to each other, but conditions can change quickly as go up and down Makakilo Drive.

3. Is within 15% of the size of your house. Unless you live in a townhouse or condo complex, you’re unlikely to find houses the exact same size as your own, but you do need to keep it close. A 2500 sqft house in Kailua is not a good comparative house for an 1800 sqft house, even if it is just down the street and sold last month.

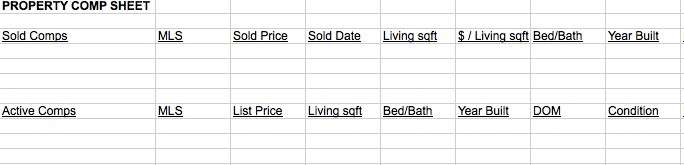

Your goal is to come up with 3-5 ‘comps’ (comparative properties). Then you can adjust for differences in property condition, lot size and other intangibles. In the end you should have a good idea within $5K-$10K of what you can expect to get for your house on the open market. If you can’t get at least 3 comps, then loosen the criteria (within reason) until you do.

If you have this done by a realtor, they will run what’s called a CMA (comparative market analysis). However, you need to make sure it’s done properly. I’ve had realtors give me properties in a CMA which were 1000ft larger than the property I was looking at! They forgot that the “C” in CMA stands for Comparative!

Lastly, have a look at active listings on the Hawaii market that fit the same criteria. That’s your competition, so price your house aggressively. It’s a buyer’s market out there — make them want to buy your house instead of that other one down the street.

Keep in mind that currently properties on Oahu are selling in roughly 35 days. If you overvalue the price of your house because of emotion or an improper CMA, then it will sit on the market while you watch other properties get snapped up. If you are working with a good realtor, then they should help you calculate the proper value. If you are doing a ‘for sale by owner’, then it’s all up to you!

Of course, if you want another set of expert eyes to help you out, then contact an active real estate investor who will give you an offer for your house in its current condition. Since they would be interested in actually being the one to buy your house directly, they will do their own CMA.

After all, the best way of finding what something is worth is to ask someone what they’re willing to buy it for!