I read an interesting article in yesterday’s Honolulu Star-Advertiser (I still keep screwing up the name since the merger). It discussed the possibility of a five-month moratorium on Hawaii foreclosures statewide. Immediately my brain started working overdrive trying to come up with the possible scenarios that could unfold from this course of action. My final take is that I think it is ultimately misguided. A foreclosure moratorium is based on the idea that there are mortgages being foreclosed upon that should not happen. A typical foreclosure occurs when the homeowner generally:

1. didn’t qualify for a loan modification

2. fell out of loan mod status

3. could not refinance

4. made no attempt to reinstate the loan with back payments

5. could not afford modified loan payments

6. could not successfully complete a short sale

7. made no attempt to do anything

8. just could no longer afford the payments for any other reason (payments spiked, job loss, etc.)

Now an improper foreclosure, like the kind I’m assuming to be the target of a moratorium, would be one where:

1. the lender failed to accept a reasonable short sale offer

2. the lender failed to properly process a short sale or loan modification package (fairly common with the bureaucracies and size of lender’s processing departments)

3. the lender realized they would make more money on a foreclosure than by working with the homeowner on a short sale or loan modification

4. homeowner could not get any reasonable form of customer service while the property was simultaneously headed to trustee sale

Of course, this is not an exhaustive list, but it makes a point. And that point is that nowhere in this second list does it mention improper foreclosure proceedings when the homeowner missed payments. The bottom line is that if you miss payments because you can’t afford your mortgage, then you’ll be in default and likely experience a foreclosure barring mitigative action. There’s nothing hazy about that. This takes us back to the robo-signing scandal of last fall when people were up in arms over the process but not the guidelines, yet spoke of it the other way around.

So What Does This Really Mean?

Now that being said, I’ve no doubt that truly improper foreclosures happen in Hawaii from time to time (as in other states), and my sympathy goes out to those homeowners. However, the bigger picture here is that those instances are few and far between. Would a moratorium stop even these rare instances from happening? Not necessarily — and only if something productive comes out of it. Right now I haven’t heard what would happen in those five months to justify its passing.

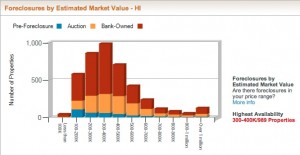

What is likely to happen, though, is that the backlog of distressed inventory grows even further. Again, these are properties that are assumed to have been legitimately foreclosed upon, i.e. the homeowner missed payments and the house proceeded toward a trustee sale. Remember, not all of Hawaii’s distressed inventory is on the market yet — there is plenty of real estate that the banks have taken back but have yet to put back on the MLS or general market for sale. Releasing too much of this at once will increase supply and effectively bring down neighborhood values and reduce their ability to recoup losses.

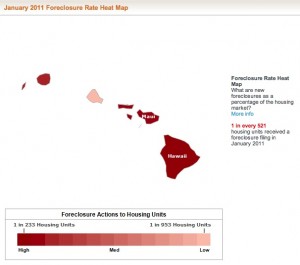

So if we already have a sizable backlog of real estate in the pipeline, do we want to stop the pipe from flowing altogether for five months or keep it flowing so that we can process it all and get every bit closer to a healthy Hawaii real estate market? By most counts, it’s going to take 1-2 years as it is without any intervention. RealtyTrac just released statistics that puts Hawaii #11 nationwide for foreclosure filings per housing unit. It’s foolish to think this is a result of improper foreclosure decisions; it’s instead a result of people just not being able to afford their mortgage any longer because of the general hard knocks in life.

However, some of the other propositions being thrown around have some possible merit. I’m particularly interested in the one that gives the mortgagor the option of a face-to-face meeting with the lender. To me, this could go great lengths to reducing true improper foreclosures. There’s also the idea of a homeowner option of converting a non-judicial foreclosure (the most common type in Hawaii) to a judicial foreclosure. That has some potential as well, though it would need certain checks and balances so as to prevent a swarming of the courts.

Ultimately, we need a solution that will give homeowners a better option to fight truly illegal foreclosures but one that doesn’t bring the whole thing to a screeching halt.

What are your thoughts? Is a foreclosure moratorium in the best interest of Hawaii? Or does it move us further away from where we need to be?

Ok let me say this. If you reply to a post on this site with “Honey…” and you’re not my mother or girlfriend, I can guarantee that I will not approve your post. Unless it only serves to amuse me, which this particular reply did. However, I’m not going to approve it anyway because it’s absurd. The person who wrote in against the moratorium wrote from an email address of a foreclosure attorney — wow, go figure! She wants to blame all the foreclosures on AIG and Enron.

So if you were expecting to see your post here or thought you’d be taking me to task, “sorry, honey”.

Everyone else may post. 🙂

Mortgage loan servicers have proven themselves to be dishonest and have no regard for the rule of law. They have actively and intentionally obstructed homeowners who have applied for modifications under HAMP and proceeded with wrongful foreclosures. This is the rule, not the exception. The proposed moratorium applies only to non-judicial foreclosures, not judicial foreclosures so the honest creditors are not deprived of their legal rights. A moratorium could have unintended consequences by people misinterpreting it, but the notion that because someone owes money and has not paid makes it ok to break the law is wrong. If a guy owes you money and you break the law by breaking into his house and taking the TV, you will be the one who is guilty of burglary and will likely go to jail. The court would not accept the fact that the guy whose house you broke into, owed you money as an excuse. Obey the law when collecting money from people. It is not too much to ask, is it? I think the moratorium is an appropriate response to this problem but there are likely to be unintended consequences that are of great concern. I understand the frustration amongst the population and the legislators but the outcome could be it causes more foreclosures in the long run. The bottom line is that they can still foreclose via the judicial method, which may be motivation to do more modifications. At this point I say go for it and see what happens but be aware of consequences that have not been thought of or considered.

Improper foreclosures have unfortunately happened, but from my experience they are not the norm, so I suppose we will disagree on this point. However, there’s no denying the ‘system’ in its current state has some serious deficiencies.

That being said, it’s these ‘unintended consequences’ you refer to that concern me. If it does serve to delay the true recovery of the Hawaii housing market, then it may indeed produce more foreclosures as a result. I’d also like to see a real game plan for what will be accomplished during the 5-month time period instead of just instituting a moratorium to ‘take a breather’.

One point that is overlooked often Michael is that many business owners in Hawaii including myself lost a substantial part of our income due to the recession. Closing my business eventually was the best option. This allowed me time to focus on starting a new business that would work in this new economy. The bank allowing our family time to stay in our home until we were back on our feet I think was a good decision. Now I’m in a position to hopefully get a modification that i can afford.

Aloha, Cary, and thanks for contributing to the conversation. It’s unfortunate that you had to close your business, but it’s great that you are working with a lending institution that’s understanding of your situation. That’s not the case for a majority of people these days, it seems.

I speak with many homeowners who hit hard times and hope for some sort of relief, whether it’s a loan modification as in your case or, if that doesn’t pan out, a successful short sale. Some folks get lucky and the all pieces fit together — others, not so much and they enter a foreclosure avoidance scenario.