Happy Fourth of July! I have to apologize for the delay since the last post. On a personal note, I’ve been back and forth to Japan a bit for family reasons and it’s tapped the writing brakes a bit. But wow, look at what’s happened in the past month!

1) Banks Take a Hit. Many of the big banks were recently whacked by authorities and downgraded by creditors. They’re now taking one more step towards an ounce of transparency. Will it make much of a difference, these financial ‘living wills’? Some are even calling for an end to the money system as we know, although I think that idea is right up there with the upcoming Mayan doomsday. (check this out, too, for a good laugh )

2) Foreclosures Crank Up. And now here comes the word that the banks are ready to ratchet up their foreclosure process. It’s been all ‘drip’ from the inventory faucet lately but that may be changing very shortly. The banks (yes, the same banks) know that they have to get rid of these non-performing assets at some point. They can’t release them all at once because a flooded market will depress the entire housing scene. But they simply have to start moving inventory.

Another interesting point of…well….interest: Hawaii was one of the few states with an increase in foreclosure inventory, according to CoreLogic just this past Friday.

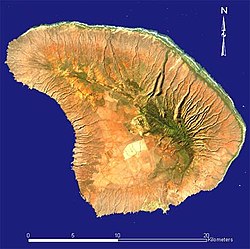

3) The Oracle Arrives. As in Oracle founder Larry Ellison who bought just about every grain of sand and remaining pineapple on Lanai. Will he hold true to his pledge that he won’t come in and give the island a ‘digital makeover’? He doesn’t have the reputation of just letting things be, but aside from some local improvements to infrastructure and such, that’s apparently what the island residents want from their new neighbor. Let Lanai continue to be Lanai — will he?

3) The Oracle Arrives. As in Oracle founder Larry Ellison who bought just about every grain of sand and remaining pineapple on Lanai. Will he hold true to his pledge that he won’t come in and give the island a ‘digital makeover’? He doesn’t have the reputation of just letting things be, but aside from some local improvements to infrastructure and such, that’s apparently what the island residents want from their new neighbor. Let Lanai continue to be Lanai — will he?

4) SPORTS (why not): The Los Angeles Kings won the Stanley Cup for the first time — ever. A lot of my ex-Flyers are on that team (I’m a Philly boy). It only took 45 years but they did it. Sure, hockey’s not big in Hawaii but we have enough mainland imports here that probably follow the NHL. I certainly can’t be the only one (I hope). Plus, LA is about as close a hockey team as we have. And they were playing New Jersey — and no one wants to see NJ win again. Ever. No one. Ever again.

In other sports news, and speaking of Philadelphia, the Flyin’ Hawaiian, Maui’s Shane Victorino is struggling along with the rest of the Fightin’ Phils, batting only .251 as we hit the halfway point of the baseball season. Come on, Shane, let’s start rallying the boys!

Rocky still believes...